The Final Frontier

November 1, 2025

The Criticality of the 'Last Mile'

The 'last mile'—the final leg of the supply chain where goods move from a local hub to the customer's doorstep—is arguably the most challenging and cost-intensive part of the logistics process, often accounting for up to 30% of the total delivery cost. In India, a country characterized by rapid urbanization, vast geography, and booming e-commerce, mastering this final stretch is not just an operational goal; it is a critical competitive advantage and a key enabler of economic growth.

The Indian last-mile delivery market is experiencing a massive surge, driven by consumer expectations for same-day and next-day delivery, and the exponential rise of quick-commerce (Q-commerce). However, this growth has traditionally been constrained by fragmented infrastructure and high operational costs. This is now changing, with government policy and massive infrastructure spending acting as the central catalyst.

Current Industry Insights and Driving Forces

The last-mile logistics sector in India is undergoing a profound transformation, marked by several key trends:

1. The E-commerce and Q-commerce Boom

The expansion of online shopping, extending into Tier-II and Tier-III cities, has dramatically increased parcel volumes and the frequency of deliveries. The rise of Q-commerce models (e.g., 10-20 minute delivery) has pressured logistics providers to establish micro-fulfillment centres and decentralized warehousing closer to the end consumer.

2. Technology Integration as the Core Enabler

Logistics players are heavily investing in Industry 4.0 technologies:

AI and Machine Learning (ML): Used for real-time route optimization, predictive analytics (predicting traffic, weather, and demand), and fleet management to reduce congestion and improve delivery speed.

IoT and Telematics: Providing real-time tracking, digital proof-of-delivery, and vehicle health monitoring, enhancing transparency and efficiency.

Automation: Streamlining urban warehouse operations, from automated inventory mapping to faster picking and dispatch.

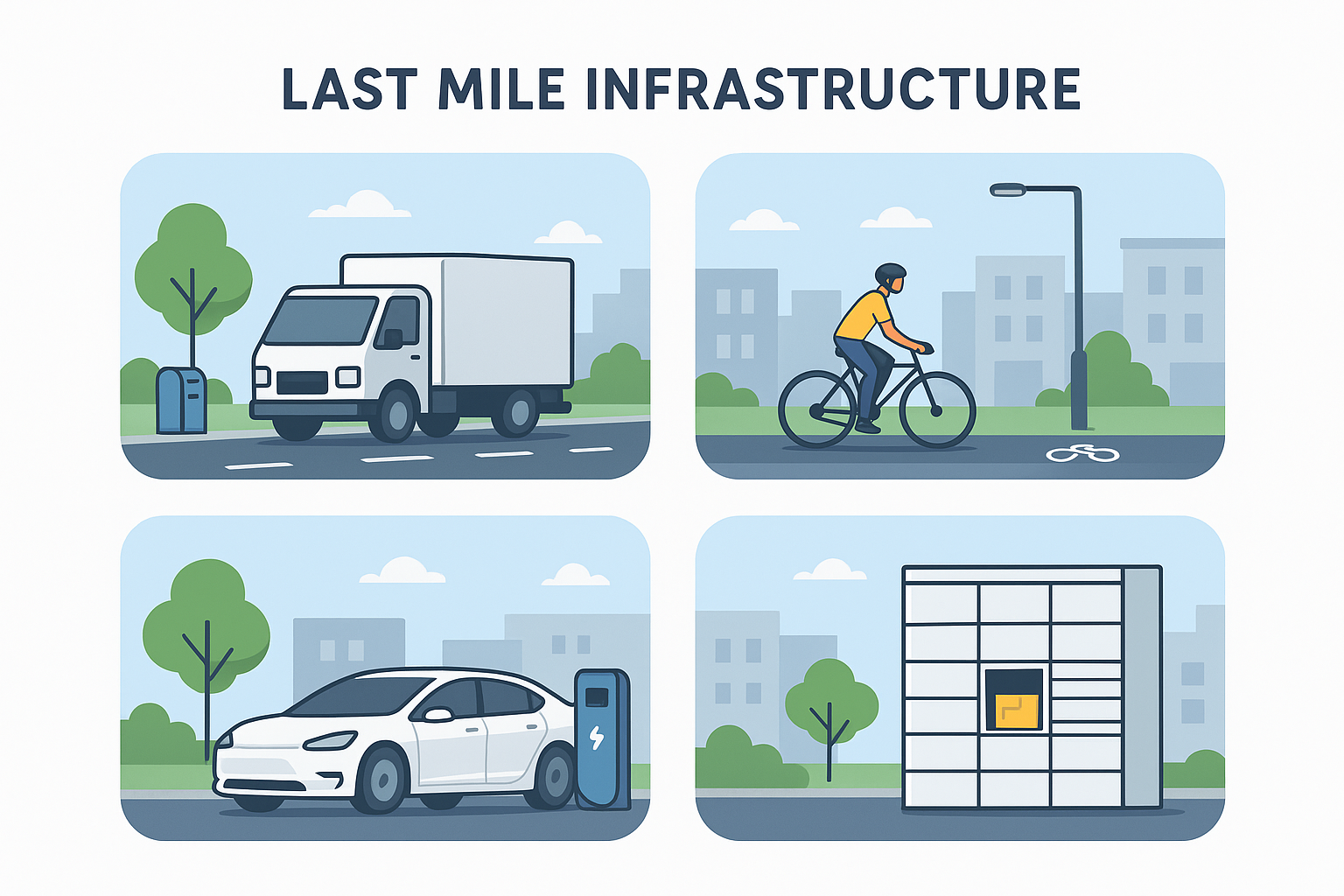

3. The Shift to Green Logistics

With traffic congestion and emissions becoming critical urban issues (Indian last-mile emissions are significantly higher than the global average), there is a strong push towards Electric Vehicles (EVs). Logistics firms are increasingly deploying electric two- and three-wheelers for intra-city deliveries, supported by government subsidies and a growing ecosystem of battery-swapping stations.

4. Operational Challenges Persist

Despite the growth, the industry still grapples with:

Address Accuracy: Poor or non-standardized addressing in many urban and semi-urban areas leads to delays and high Return-to-Origin (RTO) rates.

High Logistics Cost: The overall logistics cost in India remains high at 13-14% of GDP, compared to the global average of 8-9%. Last-mile inefficiencies contribute significantly to this.

Labour Management: Managing a vast and often high-turnover gig workforce across diverse geographies.

The Infrastructure Catalyst: Government Initiatives and Physical Upgrades

The most transformative factor reshaping India's last-mile capabilities is the targeted investment in both physical and digital infrastructure, largely driven by major government initiatives:

Initiative / Component

Contribution to Last-Mile Logistics

PM GatiShakti National Master Plan

Multimodal Integration: Coordinates 16 central ministries to build a seamless, integrated logistics network. It enables faster project approvals and planning, improving the efficiency of the entire supply chain, which trickles down to the last mile.

National Logistics Policy (NLP)

Policy Overhaul: Aims to reduce logistics cost to a global benchmark (~8% of GDP). It promotes efficiency through technology and regulatory streamlining.

Bharatmala Pariyojana

Road Network Expansion: Construction of new economic corridors, inter-corridors, and feeder routes, significantly enhancing connectivity between production centres, distribution hubs, and Tier-II/III cities. This reduces long-haul transit time, making regional hubs more viable for last-mile networks.

Dedicated Freight Corridors (DFCs)

Modal Shift: Shifts long-haul cargo from congested roads to dedicated rail lines, leading to faster, cheaper, and more reliable inter-city movement. This frees up road space and improves efficiency for the last-mile movement from rail terminals to city warehouses.

Digital Infrastructure (ULIP, LDB, e-Way Bill)

Digital Spine: The Unified Logistics Interface Platform (ULIP) integrates logistics data from various systems, providing end-to-end visibility. The e-Way Bill system has streamlined taxation, eliminating interstate checkpoints and reducing road transit times by an estimated 33% since GST's implementation, allowing for faster dispatch to last-mile hubs.

Multimodal Logistics Parks (MMLPs)

Hub Consolidation: These large-scale parks, located at key connectivity points, integrate road, rail, and port infrastructure. They serve as central sorting and distribution points, making it possible for companies to consolidate small, inefficient city warehouses into fewer, large, high-tech facilities closer to the start of the last mile.

From Chaos to Choreography

India's journey in last-mile logistics is transitioning from a high-cost, high-friction operation to a model of speed and precision. While the demand-side pressure from e-commerce provides the motive, the government's focused infrastructure push provides the means.

The strategic build-out of high-speed corridors (Bharatmala, DFCs), the digitization of the supply chain (ULIP, NLP), and the emergence of strategically placed consolidation points (MMLPs) are systematically breaking down the historical barriers. The result is a more resilient, transparent, and rapidly expanding ecosystem.

The future of last-mile logistics in India hinges on the successful convergence of three factors: Smart Technology, Green Fleets, and Integrated Infrastructure. By continuing to invest in these areas, India is not just accelerating its deliveries; it is building a foundational competitive advantage that will power its ambition to become a global logistics and manufacturing hub.

—------------------------------------------------------------------------------------------------------------------------

Want more creative ideas for your brand to engage this festive season? Connect with us on

contact@upshotbrandmedia.com or on call at +91 8962429492

Tags: